aurora co sales tax rate 2021

This is the total of state county and city sales tax rates. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

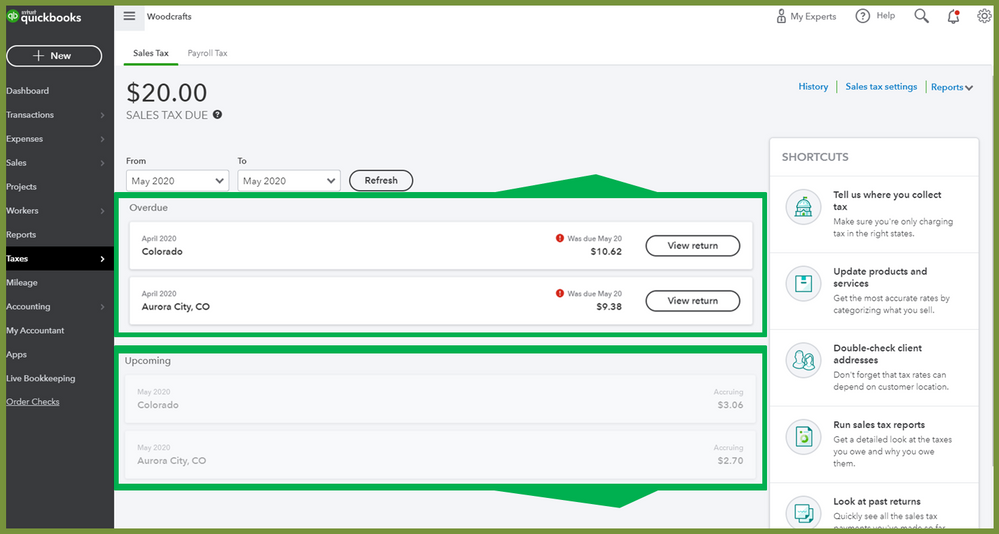

Set Up Automated Sales Tax Center

You can print a 85 sales tax table here.

. Aurora-RTD 290 100 010 025 375. The state sales tax rate in Colorado is 2900. Ad Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart.

6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax. Average Sales Tax With Local. Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use.

The december 2020 total local sales tax rate was also 8000. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The December 2020 total local sales tax rate was also 0000.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. The December 2020 total local sales tax rate was 8350. XYZ will include this on line 10 of their Aurora Sales and Use Tax.

Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8. The Aurora Illinois sales tax is 825 consisting of 625 Illinois state sales tax and 200 Aurora local sales taxesThe local sales tax consists of a 125 city sales tax and a 075. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle.

Youll find rates for sales and use tax. The December 2020 total local sales tax rate was also 8000. The minimum combined 2022 sales tax rate for Aurora Colorado is.

Effective July 1 2022. What is the sales tax rate in Aurora Colorado. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. 0375 lower than the maximum sales tax in MO. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city.

4 rows Rate. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora. XYZ must pay 375 percent Aurora use tax on all cash registers including those to be shipped to stores outside of Aurora.

The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. This sales tax will be remitted as part of your regular city of Aurora sales and use tax. With local taxes the total sales tax.

The minimum combined 2022 sales tax rate for Aurora Minnesota is. The Colorado sales tax rate is currently.

What Is Privilege Tax Types Rates Due Dates More

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Set Up Automated Sales Tax Center

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Sales Tax By State Is Saas Taxable Taxjar

Colorado Has One Of The Most Complicated Sales Tax Systems In The Country Our Tax Policy Mishmash Yields 756 Different Combinations Of Sales Taxes Businesses May Be Required To Collect R Denver

Nebraska Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Ontario Property Tax Rates Calculator Wowa Ca

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings